What are US HTS Codes? How do you find your US HTS code?

December 31, 2024

Ever wonder how packages ordered online from overseas arrive at your doorstep without a hitch? It’s easy to assume it’s just a matter of shipping labels and postage stamps, but there’s a crucial piece often overlooked: the classification codes that customs officials rely on to identify what’s inside. These codes are called HTS codes (Harmonized Tariff Schedule codes), and they play a major role in determining duties, taxes, and import regulations for your goods.

If you’re not familiar with HTS codes or find them confusing, don’t worry—you’re not alone. In this guide, we’ll break down what HTS codes are, why they matter, how they differ from similar systems, and how to ensure you’re using the right codes for your products. By the end, you’ll have the tools you need to keep your imports compliant and running smoothly.

What Is an HTS Code?

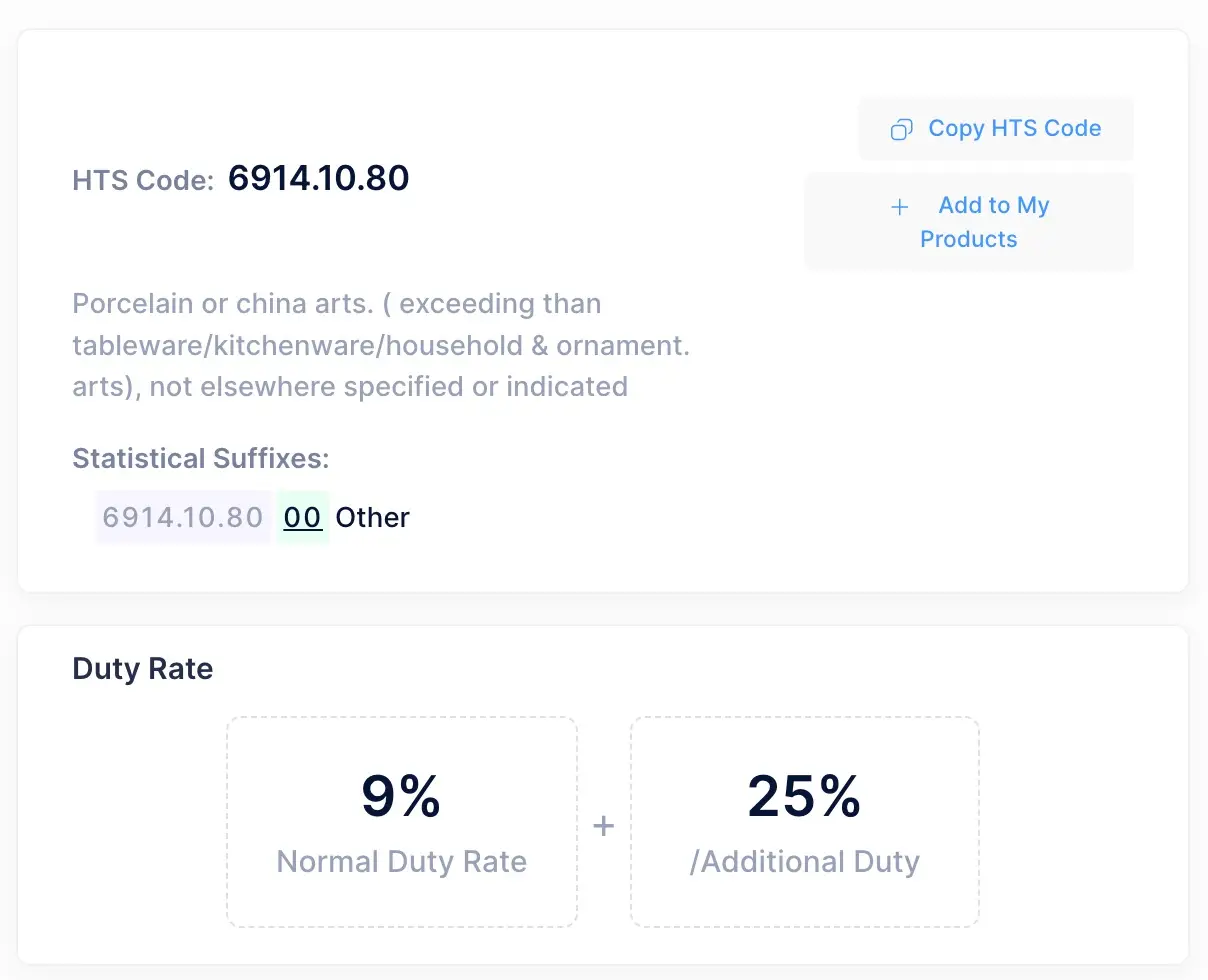

An HTS code is a standardized numerical sequence used by customs authorities to classify physical products imported into the United States. The first six digits of an HTS code align with the global Harmonized System (HS), which is recognized in more than 200 countries. This global system helps ensure that products get consistently categorized, no matter where they’re coming from or going to.

In the US, HTS codes go beyond the universal six digits by adding four more digits for a total of 10. These extra digits allow for more precise product descriptions and enable customs to apply the correct duty rates and regulations. In short, HTS codes are the US-specific extension of the broader HS codes.

Why HTS Codes Matter

1. Accurate Duty and Tax Assessment

HTS codes determine how much you owe in import duties and taxes. A small misstep in classification can lead to higher fees or even penalties.

2. Trade Compliance

From an official standpoint, using the correct HTS code ensures you stay compliant with US customs regulations. Mistakes can prompt red flags, resulting in delays, audits, or fines.

3. Smooth Customs Clearance

Getting your classification right keeps your shipments moving swiftly through customs. If your goods are flagged for misclassification, you risk shipment delays and extra paperwork.

HTS Codes vs. HS Codes vs. HTSUS Codes

- HS Codes: These are six-digit codes recognized globally. Countries worldwide use the Harmonized System to standardize product classification.

- HTS Codes: In the United States, we extend those six digits to 10, giving customs authorities more specificity on product details.

- HTSUS: You may also see references to the Harmonized Tariff Schedule of the United States (HTSUS). This is simply the official document listing all US HTS codes and their corresponding duty rates.

Essentially, HS codes are the base classification, and HTS (or HTSUS) codes are the expanded versions used within the US to determine duties and regulations at a finer level of detail.

Where Do You Get an HTS Code?

Officially, the US International Trade Commission (USITC) publishes the Harmonized Tariff Schedule in full. You can browse the massive list on their website to find the code that fits your product description. However, combing through thousands of entries can be time-consuming and confusing—especially if you’re unfamiliar with the language of trade compliance.

That’s where digital tools and expert resources come in handy. By using a service like Tariffly, you can simply search by entering a few keywords to quickly narrow down the likely options. Tools like this save you hours of trial and error, ensuring you don’t select a code that leads to costly mistakes.

How to Interpret an HTS Code

An HTS code can look like a string of 10 digits, for example: 1234.56.7890. Here’s how to make sense of it:

- First 6 Digits (HS): Identify the broader product category, recognized globally.

- Next 2 Digits: Offer a deeper sub-classification within the US.

- Final 2 Digits: Pinpoint the most specific product detail for US Customs to calculate the correct tariff.

Reading an HTS code effectively means understanding how each section narrows down your product from a broad category to a precise type. Misread one digit, and you could place your product in the wrong category—leading to overpaid duties, underpayment notices, or compliance issues.

Common Mistakes with HTS Codes

1. Guessing or “Best Guess”

HTS codes aren’t something you want to leave to chance. Relying on rough estimates or assumptions can set your business up for big surprises at the border.

2. Using Old Information

HTS codes and tariff rates can change over time due to trade policy shifts. Relying on an outdated database could mean you’re classifying goods under codes that no longer apply.

3. Dismissing Product Variations

Seemingly similar goods (like cotton shirts vs. synthetic-blend shirts) can have different codes and duties. Always double-check if slight product variations place items in different sub-classifications.

HTS Code vs. Schedule B Code

You may hear about Schedule B codes, which are used for US export statistics. While they also come from the broader Harmonized System, their primary purpose is to help track what the US exports to other countries—not to classify goods for import. In most import scenarios, you’ll focus on HTS codes rather than Schedule B codes.

How to Choose the Right HTS Code

-

Research Thoroughly

Start by describing your product in detail. Look at any distinguishing factors such as materials, function, or chemical makeup. The more specific you are, the easier it is to zero in on the correct code. -

Use Online Tools

Scrolling through complex government documents can be daunting. Digital resources like Tariffly’s HTS search take product keywords and suggest potential codes in seconds.

3. Seek Expert Advice

If you’re dealing with specialized or complex items, consider consulting a trade attorney, customs broker, or a classification specialist. Expert guidance can save you from guesswork that could end up costly.

Best Practices for Maintaining Compliance

- Stay Updated: Tariffs and trade agreements evolve. Keep tabs on any changes that might affect the HTS codes you use.

- Document Everything: Maintain clear records of how you classified each product, in case customs or a partner requests the rationale.

- Monitor Product Changes: If you modify your product’s composition or use a new supplier, confirm that your existing HTS classification still applies.

- Review Regularly: Plan to revisit your HTS codes at least once a year—or more often if you import large volumes or carry many different product lines.

Key Takeaways

- HTS codes are essential for streamlining imports and ensuring products are correctly classified when entering the US.

- They include the six-digit HS standard plus four additional digits for US-specific regulations.

- Mistakes or outdated codes can lead to higher duties, fines, or shipping delays.

- Schedule B is different from HTS—Schedule B codes track exports, while HTS codes focus on imports.

- Use online tools, maintain accurate records, and keep informed of tariff updates to stay compliant.

Use Tariffly to Verify Your HTS Codes—It’s Free

Navigating HTS codes may feel daunting, but it doesn’t have to be. Platforms like Tariffly make it much easier to classify your products correctly from the start. With Tariffly, you can search the HTS database by product keywords, cross-check for changes, and ensure your code selection lines up with current regulations. Best of all, Tariffly is free to use, giving you every reason to double-check your codes and protect your business from unpleasant surprises.

Ready to simplify your importing process and avoid costly mistakes? Give Tariffly a try today. Accurate HTS codes are just a few clicks away!